Blog

3 Best Entry-Level Accounting Roles for New Graduates

Nov 26, 2024

As an experienced financial controller, I've seen many accounting graduates enter the workforce and embark on successful careers. While there are a variety of entry-level roles available, three in particular have consistently provided the best long-term outcomes for new accountants: staff accountant, audit associate, and financial systems administrator.

In this comprehensive blog post, I'll dive deep into each of these roles - covering the typical salary ranges, job responsibilities, and long-term career trajectories. By the end, you'll have a clear understanding of the pros and cons of each option, empowering you to make an informed decision about which path might be the best fit for your goals and aspirations.

The Importance of Preparation

Before we explore the specific roles, there are three key things I always advise accounting graduates to focus on in order to secure their first job:

Maintain a Strong GPA - As a hiring manager, your academic performance is one of the primary indicators I have of your intelligence, commitment, and discipline. Aim for a GPA of 3.0 or higher, with 3.5+ being ideal.

Get Involved in Extracurricular Activities - Participation in student organizations, volunteer work, or even a part-time job demonstrates valuable soft skills like leadership, initiative, and time management. These experiences can help offset your lack of full-time work history.

Build Your Resume Early - Don't wait until graduation to start building your resume. Look for opportunities, even small ones, to gain relevant experience - whether that's an internship, a side gig, or volunteer work. The more you can populate your resume, the better.

By focusing on these three areas, you'll position yourself as an attractive candidate and increase your chances of landing one of the top entry-level accounting roles. Now, let's dive into the specifics of each option.

Entry-Level Staff Accountant

The staff accountant role is one of the most common entry points into the accounting field. As a staff accountant, you can expect to earn a salary in the range of $58,000 to $74,000 per year, with the national average landing around $65,000.

Qualifications and Job Responsibilities

The primary qualification for a staff accountant position is a bachelor's degree in accounting. Relevant experience is not strictly required, as many employers are willing to hire recent graduates and provide on-the-job training.

In this role, your day-to-day responsibilities would typically include:

Preparing, examining, and analyzing accounting records for various areas such as cash, bank accounts, and patient accounts receivable

Conducting monthly bank reconciliations

Researching and reconciling the monthly unapplied cash account

Calculating monthly patient receivables using specialized software

Assisting with other ad-hoc accounting tasks as needed

The staff accountant position provides a solid foundation in core accounting principles and practices, allowing you to develop a well-rounded skill set. It's an excellent starting point for those looking to build a career in the field.

Career Trajectory

As a staff accountant, your career trajectory could unfold as follows:

5 Years Out: Accounting Manager - Earning around $150,000 per year

10 Years Out: Controller - Earning around $250,000 per year

15 Years Out: Vice President of Accounting - Earning around $300,000 per year (not including bonuses or equity)

The staff accountant role offers a clear path for advancement, with opportunities to progress into managerial and leadership positions within the accounting and finance functions of an organization. With the right skills, experience, and dedication, you can steadily climb the corporate ladder and achieve significant career growth and earning potential.

Audit Associate

Another popular entry-level accounting role is that of an audit associate. This was the path I chose when I graduated from college in 2005, working as an auditor at PwC for a few years before transitioning to the private sector.

Qualifications and Job Responsibilities

To become an audit associate, you'll typically need a bachelor's degree in accounting or finance, along with 0-3 years of relevant experience. Proficiency in Microsoft Excel is also a common requirement, as it's a critical tool used throughout the audit process.

As an audit associate, your day-to-day responsibilities would include:

Performing audits as part of an engagement team, often managing a specific area of the audit

Communicating with clients to gather information and documentation needed for the audit

Preparing audit workpapers and adjusting trial balances (note that auditors do not actually adjust the client's trial balance - that's the responsibility of the client)

Analyzing and compiling financial statements into written reports for clients and colleagues

Fostering relationships with clients and co-workers

Traveling for 15-20% of the time to conduct on-site audits

The audit associate role provides valuable exposure to a wide range of industries and financial reporting practices. It also offers the opportunity to earn a CPA license, which can significantly enhance your career prospects.

Career Trajectory

As an audit associate, your career trajectory could look like this:

5 Years Out: Audit Manager - Earning around $180,000 per year

10 Years Out: Director in Public Accounting - Earning around $250,000 to $300,000 per year

15 Years Out: Managing Director or Partner in Public Accounting - Earning around $350,000 to $450,000 per year

Alternatively, you could choose to exit public accounting after a few years and transition into a controller role in the private sector, which would put you on a similar trajectory to the staff accountant path.

The audit associate position provides a versatile foundation, allowing you to either advance within public accounting or leverage your experience to pursue opportunities in corporate accounting, financial analysis, or even other fields like equity research or internal audit.

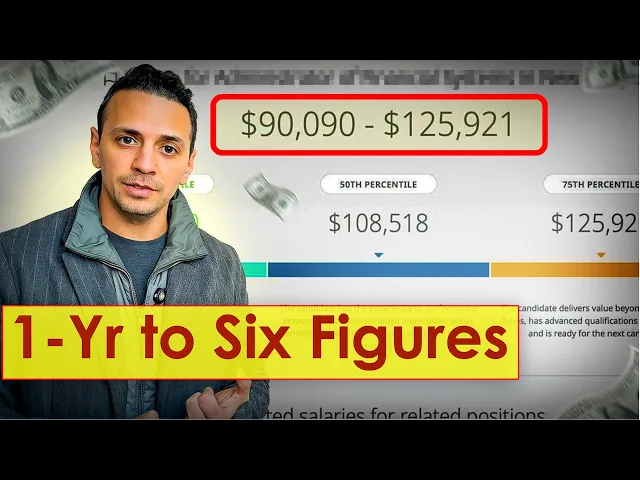

Entry-Level Financial Systems Administrator

The third entry-level accounting role I want to highlight is that of a financial systems administrator. This position has gained significant momentum in recent years, as companies have become increasingly reliant on technology to manage their accounting and finance functions.

Qualifications and Job Responsibilities

To become a financial systems administrator, you'll typically need a bachelor's degree in business administration, computer science, accounting, or a related field. Relevant experience can range from 0 to 2 years, as this is often an entry-level role.

As a financial systems administrator, your primary responsibilities would include:

Providing operational and technical support for the organization's financial systems, troubleshooting issues, and collaborating with IT to develop solutions

Developing and adhering to production support procedures to align with financial audit requirements, including maintaining detailed documentation

Identifying root causes of system issues and working to resolve them

Updating and maintaining business process documentation related to system functionality

Defining and documenting requirements for system configuration and custom software development

Assisting with making minor system enhancements through an agile software development lifecycle

Analyzing client processes, developing functional requirements, and translating them into technical designs

In this role, you'll serve as the gatekeeper and administrator for the organization's core financial systems, such as the enterprise resource planning (ERP) software. You'll be responsible for managing user access, provisioning new users, and ensuring the seamless integration of various financial applications.

Career Trajectory

As a financial systems administrator, your career trajectory could unfold as follows:

5 Years Out: Financial Systems Manager - Earning around $170,000 per year

10 Years Out: Director of Financial Systems - Earning around $250,000 per year

15 Years Out: Vice President of Financial Systems - Earning around $300,000 to $400,000 per year

The financial systems administrator role provides a unique blend of accounting knowledge and technical expertise. As you progress in your career, you'll have the opportunity to take on increasingly strategic responsibilities, shaping the technology infrastructure that supports the finance and accounting functions of the organization.

Choosing the Right Path

When it comes to selecting the best entry-level accounting role for you, there's no one-size-fits-all answer. Each of the three options I've outlined - staff accountant, audit associate, and financial systems administrator - offers its own set of advantages and considerations.

Staff Accountant

The staff accountant role is an excellent choice for those who prefer a more traditional accounting career path, with a focus on core accounting tasks and a clear trajectory towards managerial and leadership positions. This role provides a solid foundation in accounting principles and practices, making it a great starting point for many aspiring accountants.

Audit Associate

The audit associate position is well-suited for individuals who are interested in gaining exposure to a wide range of industries and financial reporting practices. The opportunity to earn a CPA license and the versatility of the audit skillset make this role a popular choice, with the potential to open doors to a variety of career paths, both within public accounting and in the private sector.

Financial Systems Administrator

The financial systems administrator role is an excellent option for those who possess a blend of accounting knowledge and technical aptitude. This position allows you to leverage your understanding of accounting principles while also developing expertise in financial systems and technology. As companies continue to rely more heavily on technology, the demand for skilled financial systems administrators is likely to grow.

Ultimately, the best entry-level accounting role for you will depend on your personal interests, strengths, and long-term career goals. I encourage you to carefully consider each option, reflect on your own preferences and aspirations, and make the choice that aligns best with your vision for the future.

Regardless of the path you choose, remember to focus on building a strong academic foundation, gaining relevant experience, and continuously developing your skills. With dedication and hard work, you can position yourself for a rewarding and successful career in the dynamic field of accounting.

If you're interested in further enhancing your accounting and finance knowledge, I invite you to check out the Controller Academy - a comprehensive online learning platform that I've created to help professionals like yourself achieve their career goals. Use the coupon code "30OFFPrice" to receive a 30% discount on any of the courses.

I wish you all the best in your accounting journey. Remember, the path you choose is just the beginning - the true measure of success lies in the growth, impact, and fulfillment you'll experience along the way.

Bill Hanna

Founder, Controller Academy

Hey, I'm Bill Hanna.

I have had 18+ years of progressive roles in Accounting and Finance, both in Manufacturing and SAAS.

I summarize my experiences in my courses, so you don’t have to spend years learning them!!

Ready to take your Accounting career to the next level?

Join the Controller Academy

Interviewing for an Accounting role? Nail your interview with our program!