Blog

Cost of Goods Sold: CPG vs. SaaS

Jan 23, 2026

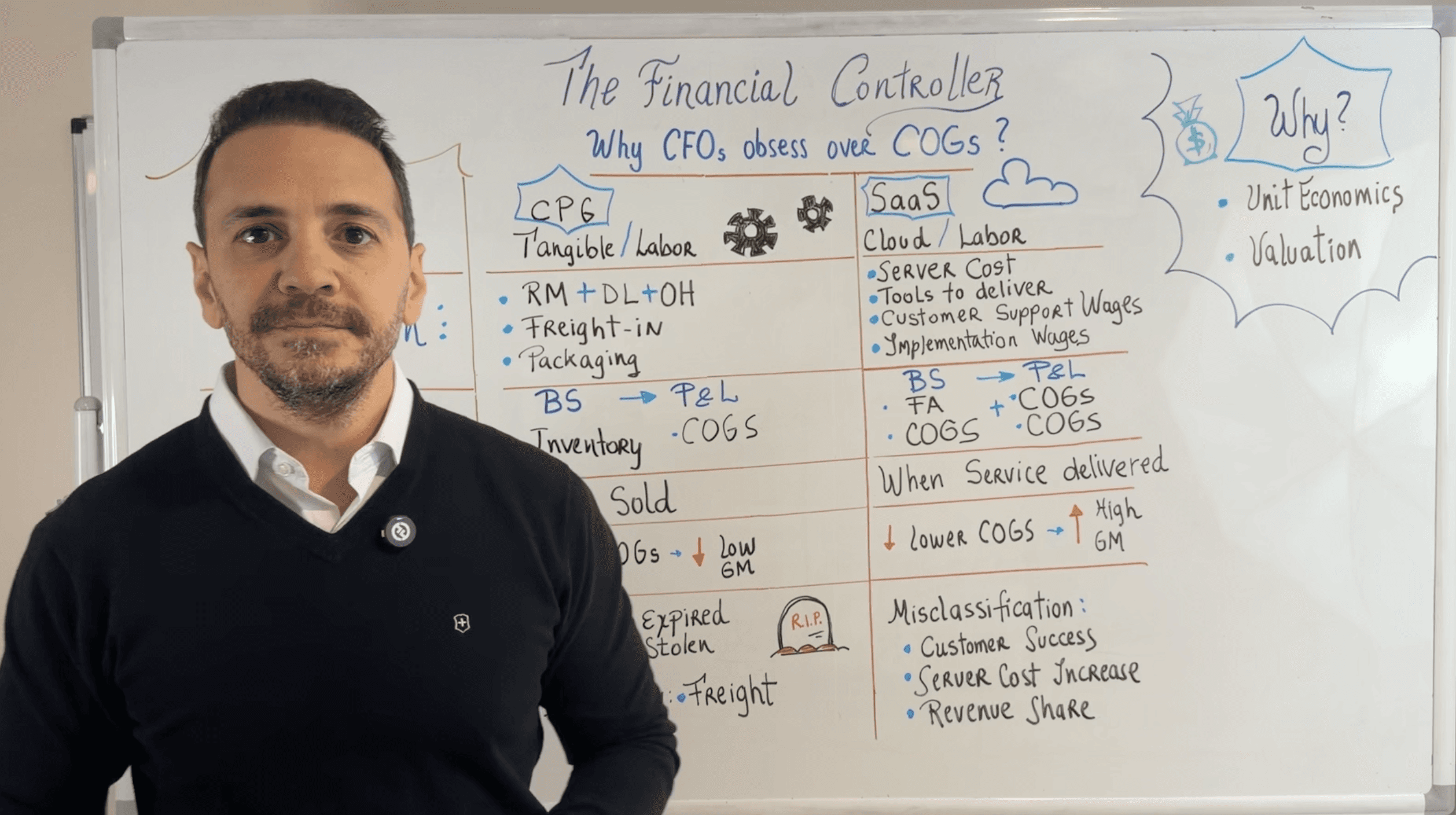

In the world of business, understanding the cost of goods sold (COGS) is crucial for maintaining a healthy financial footing. Whether you're operating in the consumer packaged goods (CPG) industry or the software-as-a-service (SaaS) space, the intricacies of COGS can have a significant impact on your bottom line. In this comprehensive blog post, we'll dive deep into the differences between COGS in CPG and SaaS, exploring the key components, common mistakes, and strategies for optimizing your financial performance.

The Anatomy of COGS: CPG vs. SaaS

CPG COGS

In the CPG industry, the cost of goods sold is primarily composed of tangible and labor-related expenses. These include:

Raw Materials: The physical components that go into the production of your products.

Direct Labor: The wages and salaries of the employees directly involved in the manufacturing process.

Overhead: The indirect costs associated with production, such as utilities, rent, and maintenance.

Packaging: The materials used to package and protect your products.

Freight In: The costs incurred to transport raw materials and components to your production facilities.

The key distinction in the CPG COGS is that these expenses are directly tied to the physical goods being produced and sold. When a product is sold, the corresponding COGS is recorded on the income statement, reflecting the true cost of delivering that item to the customer.

SaaS COGS

In the SaaS industry, the cost of goods sold takes on a different form. Instead of tangible goods, the primary COGS components are related to the delivery of the software service. These include:

Cloud-based Costs: Expenses associated with hosting and maintaining the software infrastructure, such as server costs, data storage, and bandwidth.

Customer Support Labor: The wages and salaries of the employees responsible for providing technical support and customer service.

Implementation Labor: The costs of the employees who work on implementing the software for new customers.

Software Licenses: If the SaaS platform utilizes third-party software licenses, the amortized cost of those licenses is included in COGS.

In the SaaS model, COGS is typically recorded when the service is delivered to the customer, rather than when the physical product is sold. This is particularly important for multi-year subscription contracts, where the COGS must be amortized over the duration of the service delivery.

The Balance Sheet and Income Statement Connection

CPG COGS and the Balance Sheet

In the CPG industry, the COGS journey begins on the balance sheet. Raw materials, work-in-progress, and finished goods are all recorded as inventory assets. When a product is sold, the corresponding COGS is then recognized on the income statement, reflecting the true cost of the goods that were sold.

This balance sheet-to-income statement flow is crucial for accurately tracking the cost of your CPG products. Proper inventory management and cost allocation are essential to ensure that the COGS figure accurately represents the resources consumed in generating revenue.

SaaS COGS and the Balance Sheet

The SaaS business model presents a slightly different relationship between the balance sheet and income statement. While some SaaS-related assets, such as software licenses, may be capitalized on the balance sheet and amortized over time, the majority of COGS in the SaaS world is recorded directly on the income statement.

This is because the primary COGS components, such as cloud-based costs and customer support labor, are typically expensed as they are incurred, rather than being capitalized. The exception is when a SaaS company acquires a software license, which would then be amortized and included in COGS over the life of the license.

Gross Margin: CPG vs. SaaS

CPG Gross Margin

In the CPG industry, the cost of goods sold is generally higher compared to the revenue generated from product sales. This results in a lower gross margin, typically ranging from 20% to 40%. The high COGS in CPG is primarily due to the tangible nature of the products, the costs associated with raw materials, labor, and overhead.

To maintain a healthy gross margin, CPG companies must focus on optimizing their production processes, negotiating favorable supplier contracts, and implementing efficient inventory management strategies. Minimizing waste, reducing material costs, and streamlining labor expenses can all contribute to improving the gross margin in the CPG space.

SaaS Gross Margin

In contrast, the SaaS business model typically enjoys a much higher gross margin, often ranging from 70% to 90%. This is due to the relatively lower COGS associated with delivering software-based services, as the primary expenses are related to cloud infrastructure and labor costs.

The scalable nature of SaaS platforms allows companies to serve a large customer base with minimal incremental COGS. As the customer base grows, the fixed costs of the SaaS infrastructure can be spread across a larger revenue base, resulting in a higher gross margin.

To maintain and improve their gross margin, SaaS companies must focus on optimizing their cloud infrastructure costs, streamlining customer support and implementation processes, and carefully managing the amortization of any software licenses or other capitalized assets.

Common Mistakes in COGS Accounting

CPG COGS Mistakes

In the CPG industry, some common mistakes in COGS accounting include:

Waste and Shrinkage: Failure to properly account for expired goods, stolen inventory, or other forms of waste can lead to an underestimation of COGS.

Freight Misclassification: Incorrectly categorizing freight-out expenses as COGS instead of operating expenses can skew the financial reporting.

Overhead Allocation: Improper allocation of indirect production costs, such as utilities and maintenance, can result in an inaccurate COGS calculation.

To avoid these pitfalls, CPG companies must implement robust inventory management systems, establish clear policies for freight expense classification, and develop a well-defined methodology for allocating overhead costs to the COGS.

SaaS COGS Mistakes

In the SaaS industry, common COGS accounting mistakes include:

Customer Success Misclassification: Incorrectly categorizing customer success and support expenses as COGS, when they should be considered selling and marketing expenses.

Uncontrolled Cloud Infrastructure Costs: Failing to closely monitor and manage the increasing costs of cloud-based services, such as server usage, data storage, and bandwidth.

Improper Revenue Share Allocation: Incorrectly recording revenue-sharing arrangements with partners as COGS, when they should be classified as selling expenses.

To mitigate these issues, SaaS companies should establish clear guidelines for expense categorization, implement robust cost-tracking systems for their cloud infrastructure, and carefully review any revenue-sharing agreements to ensure accurate COGS reporting.

Optimizing COGS: Strategies for CPG and SaaS

CPG COGS Optimization

To optimize COGS in the CPG industry, companies should consider the following strategies:

Supplier Negotiations: Negotiate favorable terms with raw material suppliers to reduce the cost of goods.

Process Improvements: Streamline production processes, reduce waste, and increase efficiency to lower labor and overhead costs.

Inventory Management: Implement robust inventory control systems to minimize the risk of expired or stolen goods, which can inflate COGS.

Packaging Optimization: Explore cost-effective packaging solutions that maintain product quality and protect the brand.

Transportation Efficiency: Optimize freight and logistics to minimize the costs associated with transporting raw materials and finished goods.

By focusing on these areas, CPG companies can work to improve their gross margin and enhance their overall financial performance.

SaaS COGS Optimization

In the SaaS industry, strategies for optimizing COGS include:

Cloud Infrastructure Optimization: Continuously monitor and manage cloud-based costs, leveraging cost-saving features and scaling resources as needed.

Customer Support Efficiency: Streamline customer support processes, automate routine tasks, and optimize staffing levels to reduce labor-related COGS.

Implementation Process Improvement: Enhance the efficiency of the implementation process, reducing the time and resources required to onboard new customers.

Software License Management: Carefully manage the acquisition and amortization of any third-party software licenses to ensure accurate COGS reporting.

Revenue Share Allocation: Thoroughly review any revenue-sharing arrangements with partners to ensure that the COGS allocation is appropriate and aligned with the nature of the partnership.

By implementing these strategies, SaaS companies can optimize their COGS, maintain a healthy gross margin, and drive sustainable growth.

Conclusion

In the ever-evolving business landscape, understanding the nuances of cost of goods sold is crucial for both CPG and SaaS companies. By recognizing the key differences in COGS components, the balance sheet-to-income statement relationship, and the impact on gross margin, companies can make informed decisions to improve their financial performance.

Whether you're operating in the CPG or SaaS industry, staying vigilant about common COGS accounting mistakes and implementing targeted optimization strategies can help you gain a competitive edge. By mastering the intricacies of COGS, you can unlock new opportunities for growth, profitability, and long-term success.

Bill Hanna

Founder, Controller Academy

Hey, I'm Bill Hanna.

I have had 18+ years of progressive roles in Accounting and Finance, both in Manufacturing and SAAS.

I summarize my experiences in my courses, so you don’t have to spend years learning them!!

Ready to take your Accounting career to the next level?

Join the Controller Academy

Interviewing for an Accounting role? Nail your interview with our program!