Blog

EBITDA vs. Operating Cash Flow: A CFO's Perspective

Jan 23, 2026

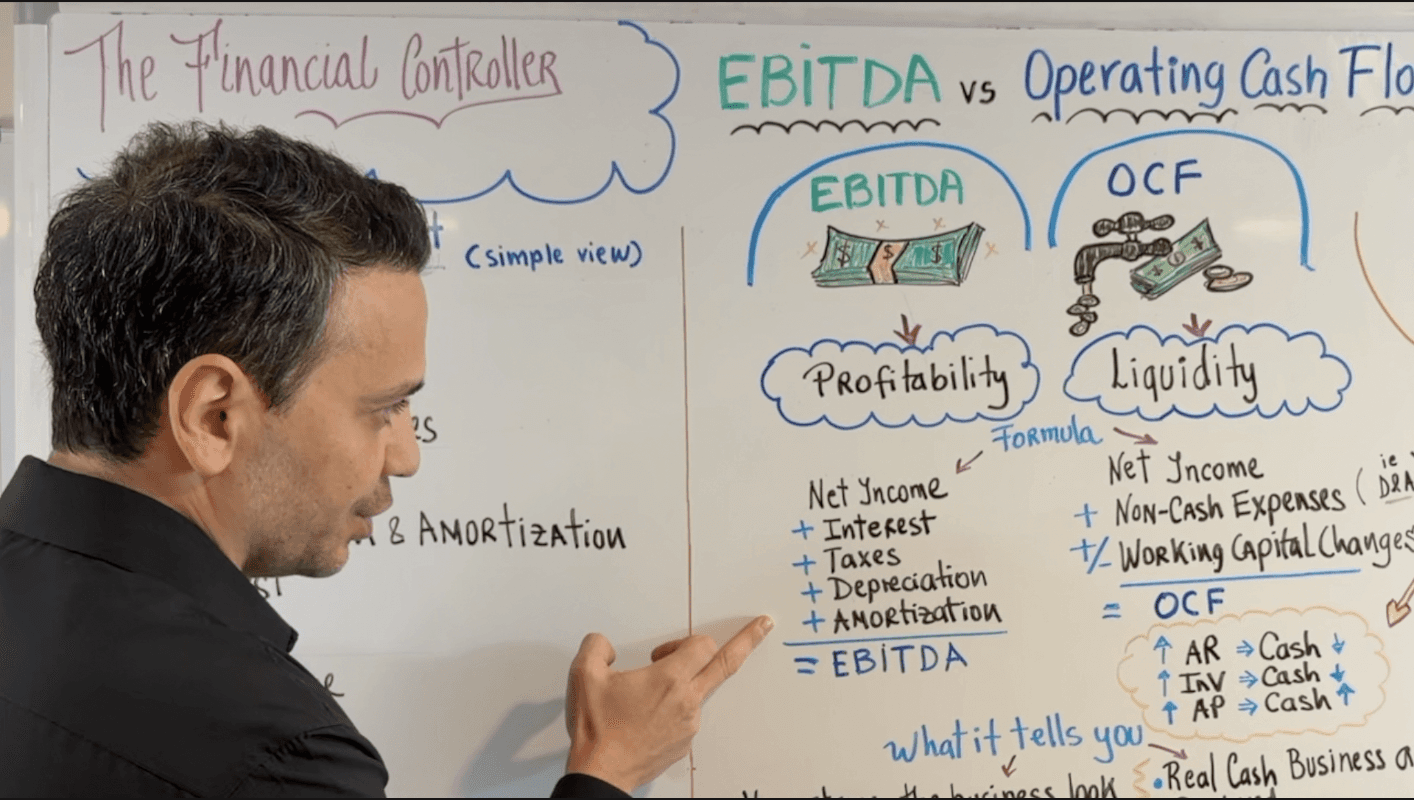

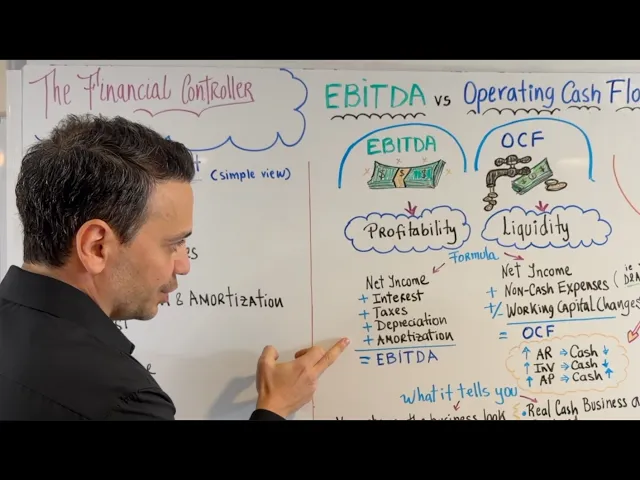

Understanding the Difference Between EBITDA and Operating Cash Flow

As a CFO, navigating the complexities of financial metrics is a crucial part of the job. Two key measures that often come into play are EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and Operating Cash Flow (OCF). While both provide valuable insights, they offer distinct perspectives on the financial health and performance of a business. In this comprehensive blog post, we'll dive deep into the differences between EBITDA and OCF, exploring how successful CFOs leverage these metrics to make informed decisions and drive their organizations forward.

EBITDA: Focusing on Profitability

EBITDA is a widely used metric that aims to provide a clear picture of a company's core operating profitability. By removing the impact of financing and accounting decisions, EBITDA allows for a more apples-to-apples comparison of a business's underlying performance, regardless of its capital structure or depreciation policies.

The formula for calculating EBITDA is as follows:

Net Income

+ Interest Expense

+ Income Tax Expense

+ Depreciation Expense

+ Amortization Expense

By adding back interest, taxes, depreciation, and amortization to net income, EBITDA gives us a sense of the company's profitability before considering the impact of these non-operating and non-cash expenses. This metric is particularly useful for:

Assessing Profitability: EBITDA provides a clear picture of the core operating profitability of a business, allowing for a more accurate assessment of its financial performance.

Comparing Across Companies: EBITDA enables the comparison of profitability across different companies, even if they have varying capital structures or accounting policies.

Valuation and Debt Metrics: EBITDA is widely used in valuation models, such as those employed by private equity firms, and in calculating debt-related metrics like the debt-to-EBITDA ratio.

While EBITDA provides valuable insights into a company's profitability, it's important to note that it does not consider the impact of working capital changes or the company's ability to generate cash. This is where Operating Cash Flow (OCF) comes into play.

Operating Cash Flow: Focusing on Liquidity and Sustainability

Operating Cash Flow (OCF) is a metric that focuses on the actual cash generated by a company's core business operations. Unlike EBITDA, which looks at profitability on paper, OCF provides a more realistic picture of the company's ability to generate and manage cash, which is crucial for the long-term sustainability of the business.

The formula for calculating Operating Cash Flow is as follows:

Net Income

+ Non-Cash Expenses (e.g., Depreciation, Amortization, Stock-Based Compensation)

+ / - Changes in Working Capital (Accounts Receivable, Inventory, Accounts Payable)

By starting with net income and then adding back non-cash expenses while accounting for changes in working capital, OCF gives us a clear understanding of the actual cash the business is able to generate from its operations. This metric is particularly useful for:

Assessing Liquidity: OCF provides insights into the company's ability to meet its recurring financial obligations, such as payroll, vendor payments, and rent.

Evaluating Sustainability: OCF helps determine the long-term viability of the business by revealing its capacity to generate cash to sustain and grow operations.

Exposing Working Capital Inefficiencies: OCF highlights any issues or inefficiencies in the management of working capital, such as slow collections from customers or excessive inventory buildup.

While EBITDA focuses on profitability, OCF emphasizes the company's ability to convert that profitability into actual cash flow, which is essential for the business's long-term success.

CFO Insights: Balancing EBITDA and Operating Cash Flow

Successful CFOs understand the importance of considering both EBITDA and Operating Cash Flow when evaluating the financial health and performance of a business. By analyzing these two metrics, CFOs can gain a comprehensive understanding of the company's financial landscape and make more informed decisions.

Here are some key insights that CFOs can glean from EBITDA and OCF:

Profitability vs. Liquidity: EBITDA focuses on profitability, while OCF emphasizes liquidity and the sustainability of the business. A CFO needs to consider both perspectives to get a complete picture of the company's financial standing.

Accounting Adjustments: Both EBITDA and OCF involve adjustments to net income, such as the addition of depreciation and amortization. However, OCF also considers changes in working capital, which EBITDA ignores.

Valuation and Planning: EBITDA is widely used in valuation models and debt metrics, while OCF is more relevant for cash flow planning, inventory management, and overall business sustainability.

By analyzing both EBITDA and OCF, CFOs can gain valuable insights that inform their decision-making processes. For example, a company with high EBITDA but low OCF may indicate inefficiencies in working capital management, such as slow collections from customers or excessive inventory buildup. Conversely, a company with low EBITDA but strong OCF may suggest a more modest but resilient business model that can weather disruptions.

Ultimately, successful CFOs recognize that EBITDA and OCF are complementary metrics that provide a comprehensive view of a company's financial health. By considering both, they can make more informed decisions, optimize the business's financial performance, and ensure its long-term sustainability.

Real-Life Cases: Navigating EBITDA and Operating Cash Flow

In the real world, CFOs often encounter scenarios where EBITDA and OCF present different pictures of a company's financial performance. Understanding these cases can help CFOs make more informed decisions and effectively manage their organizations.

Case 1: High EBITDA, Low Operating Cash Flow

In this scenario, a company may have a high EBITDA, indicating strong profitability on paper. However, the low OCF suggests that the business is struggling to convert that profitability into actual cash flow. This could be due to inefficiencies in working capital management, such as:

Slow collections from customers, leading to a buildup in accounts receivable

Excessive inventory levels, tying up cash in non-productive assets

In this case, the CFO would need to focus on optimizing the company's working capital management to improve its cash conversion cycle and ensure the long-term sustainability of the business.

Case 2: Low EBITDA, Strong Operating Cash Flow

Conversely, a company may have a relatively low EBITDA, indicating modest profitability on paper. However, the strong OCF suggests that the business is effectively managing its cash flow and can weather disruptions. This could be the case for a company that:

Charges customers upfront, resulting in a healthy cash position

Efficiently manages its inventory and supplier relationships, maintaining a favorable working capital position

Operates in a stable, low-margin industry but generates consistent cash flow

In this scenario, the CFO may focus more on the company's cash flow sustainability and resilience, rather than solely on its profitability metrics. This could be particularly important in industries with high volatility or where access to capital is limited.

Conclusion: Mastering the Balance Between EBITDA and Operating Cash Flow

As a CFO, navigating the complexities of financial metrics is a critical part of the job. By understanding the differences between EBITDA and Operating Cash Flow, and how to leverage these metrics effectively, you can make more informed decisions and drive your organization towards long-term success.

Remember, EBITDA provides insights into a company's core operating profitability, while OCF focuses on the actual cash generated by the business and its ability to sustain operations. Successful CFOs recognize the importance of considering both metrics, as they offer complementary perspectives on the financial health and performance of the organization.

By mastering the balance between EBITDA and OCF, you can gain a comprehensive understanding of your company's financial landscape, identify areas for improvement, and make strategic decisions that ensure the long-term viability and growth of your business.

If you're interested in further developing your financial analysis skills, be sure to check out the FP&A Academy from the Financial Controller. This comprehensive course covers the entire function of a financial analyst, from establishing a 5-year financial plan to drafting budgets, analyzing financial statements, and creating effective management presentations.

Bill Hanna

Founder, Controller Academy

Hey, I'm Bill Hanna.

I have had 18+ years of progressive roles in Accounting and Finance, both in Manufacturing and SAAS.

I summarize my experiences in my courses, so you don’t have to spend years learning them!!

Ready to take your Accounting career to the next level?

Join the Controller Academy

Interviewing for an Accounting role? Nail your interview with our program!