Blog

The 80/20 Rule in Accounting: 3 High-Impact Skills to Boost Your Efficiency

Aug 14, 2025

Mastering the 80/20 Rule in Accounting: 3 High-Impact Skills to Boost Your Efficiency

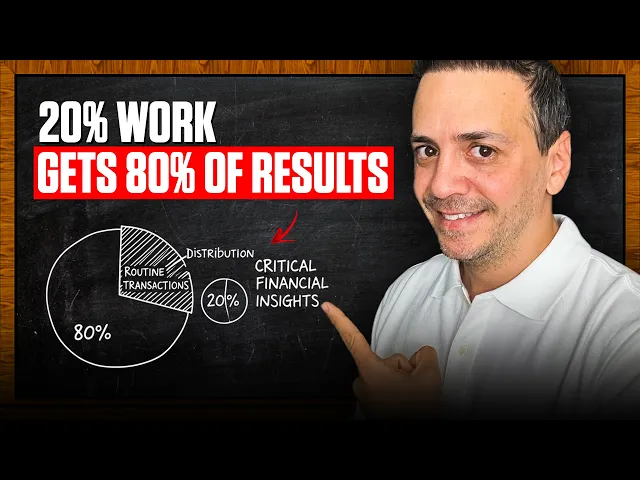

As an accounting professional, you're constantly striving to maximize your productivity and deliver exceptional results for your organization. One powerful principle that can help you achieve this is the 80/20 rule, also known as the Pareto principle. This rule states that 20% of your efforts will generate 80% of your results, suggesting that by focusing on the right high-leverage tasks, you can dramatically improve your overall efficiency and impact.

In this comprehensive blog post, we'll dive deep into the 80/20 rule in accounting and explore three key skills that can help you unlock your full potential. Whether you're a seasoned controller or aspiring to take your career to the next level, mastering these high-impact competencies will set you apart from your peers and position you as a true accounting superstar.

1. Mastering the Period-End Closing Process

The first critical skill in the 80/20 rule of accounting is the ability to effectively manage the period-end closing process. This encompasses the day-to-day transactions, as well as the month-end activities that ensure your organization's financial records are accurate, complete, and up-to-date.

At the core of the period-end closing process are the routine transactions, such as billing, payroll, accounts payable, and employee expenses. These are the fundamental building blocks that keep your organization's financial engine running smoothly. However, the true power lies in the non-routine transactions, which include accrual adjustments, account reconciliations, and financial statement analysis.

Creating a Comprehensive Closing Checklist:

To streamline the period-end closing process, it's essential to develop a detailed closing checklist. This checklist should serve as a roadmap, outlining all the necessary tasks and responsibilities to ensure a seamless and efficient close.

Your closing checklist should include the following key elements:

- Routine Transactions: Billing, accounts receivable, accounts payable, credit cards, employee expenses, and other day-to-day activities.

- Non-Routine Transactions: Accruals, fixed assets, reconciliations, and other month-end adjustments.

- Timing: Assign a specific timeline for each task, such as "completed on working day two".

- Responsibilities: Clearly identify the individuals responsible for preparing and reviewing each task.

- Status Tracking: Maintain a status column to monitor the progress of each task (e.g., done, in progress, not yet started).

By creating a comprehensive closing checklist, you can ensure that no critical task is overlooked, and the entire process is executed with precision and efficiency. This not only helps you meet your reporting deadlines but also provides a solid foundation for accurate and reliable financial information.

To get a head start on your closing checklist, be sure to download the free Master Period-End Accounting Closing Checklist.

2. Reconciliations

The second high-leverage skill in the 80/20 rule of accounting is the ability to perform effective reconciliations. Reconciliations are the process of ensuring that the balances in your accounting records match the external support, such as bank statements or vendor invoices.

Reconciliations serve several critical purposes:

- Assurance: Reconciliations provide the controller and management with reasonable assurance that the balances in the accounting records are accurate and reliable.

- Compliance: For publicly traded companies, reconciliations are often a regulatory requirement to ensure financial reporting compliance.

- Fraud Prevention: Reconciliations can help detect fraudulent activities by uncovering any discrepancies between the accounting records and external sources.

- Unrecorded Transactions: Reconciliations can uncover unrecorded transactions or activities that were previously overlooked, preventing prior-period adjustments.

To demonstrate the reconciliation process, let's walk through an example of a balance sheet account reconciliation for the "Deferred Commission" account.

The reconciliation process typically involves the following steps:

1. Create a Cover Sheet: This cover sheet should include the account number, account name, and a brief description of the reconciliation.

2. Gather the Necessary Information: Obtain the beginning balance, any activity during the period, and the ending balance from the accounting records.

3. Reconcile the Balances: Compare the ending balance from the accounting records to the external support, such as a vendor statement or a detailed amortization schedule.

4. Investigate and Resolve Differences: If there are any discrepancies between the accounting records and the external support, investigate the root cause and make the necessary adjustments.

5. Document the Reconciliation: Clearly document the reconciliation process, including the sources of information, any adjustments made, and the final reconciled balance.

By mastering the art of reconciliations, you can ensure the accuracy and reliability of your organization's financial information, while also uncovering potential issues and preventing costly prior-period adjustments.

To further enhance your reconciliation skills, be sure to check out the free Balance Sheet Reconciliation Example.

3. Mastering Financial Statement Analysis

The third high-leverage skill in the 80/20 rule of accounting is the ability to perform comprehensive financial statement analysis. This skill encompasses two main types of analysis: accounting analysis and financial/managerial analysis.

Accounting Analysis

The purpose of accounting analysis is to identify any accounting anomalies or errors within the financial statements. This is typically done through a month-over-month flux analysis, which compares the current period's financial results to the previous period, highlighting any significant changes or variances.

By conducting a thorough accounting analysis, you can:

- Detect and correct any accounting mistakes or irregularities.

- Understand the underlying reasons for the changes in your financial results.

- Ensure the accuracy and integrity of your organization's financial reporting.

Financial/Managerial Analysis

The financial/managerial analysis, on the other hand, focuses on using the financial information to support business decision-making. This type of analysis can take several forms, including:

- Actual vs. Budget: Comparing the organization's actual financial results to the budgeted figures, identifying any variances, and analyzing the underlying causes.

- Vertical Analysis: Expressing each line item on the income statement as a percentage of total revenue, providing insights into the relative importance and composition of the organization's financial performance.

- Ratio Analysis: Calculating various financial ratios, such as gross margin, operating margin, current ratio, and quick ratio, to assess the organization's financial health, efficiency, and profitability.

By mastering financial statement analysis, you can provide valuable insights to your organization's leadership, enabling them to make informed decisions and drive strategic initiatives. This, in turn, solidifies your role as a trusted business partner and a key contributor to the organization's success.

To get a head start on your financial analysis skills, be sure to download the free Actual vs. Budget Analysis template.

Unlock Your Accounting Superpowers with the 80/20 Rule

By focusing on these three high-leverage skills - period-end closing, reconciliations, and financial statement analysis - you can unlock your full potential as an accounting professional and truly embody the 80/20 rule. These skills not only boost your efficiency and productivity but also position you as a valuable asset to your organization.

Remember, the key to success lies in mastering these high-impact competencies. Invest the time and effort to develop your skills, and you'll reap the rewards of increased efficiency, improved financial reporting, and greater strategic influence within your organization.

Ready to take your accounting career to new heights? Enroll in the Controller Academy today and gain access to a comprehensive suite of courses that will help you become a true accounting superstar. With the 80/20 rule as your guide, you'll be well on your way to unlocking your full potential and delivering exceptional results for your organization.

Bill Hanna

Founder, Controller Academy

Hey, I'm Bill Hanna.

I have had 18+ years of progressive roles in Accounting and Finance, both in Manufacturing and SAAS.

I summarize my experiences in my courses, so you don’t have to spend years learning them!!

Ready to take your Accounting career to the next level?

Join the Controller Academy

Interviewing for an Accounting role? Nail your interview with our program!