COURSE DETAILS

Learn how to become a Corporate Controller

This course includes

8 hours

(65 lectures) of bit-size video lectures by Bill Hanna

30+ Excel

Templates to practice what you see in the lectures.

15+ Quizzes

To practice your learning along the way.

10 CPE Credits

NASBA Accredited Credits

14 days

Money back guarantee if you are not 100% satisfied!

Course Description

The Controller Academy - Learn how to become a corporate Controller is a hands-on online course designed for early/mid-career accountants and professionals seeking a deeper grasp of core accounting functions.

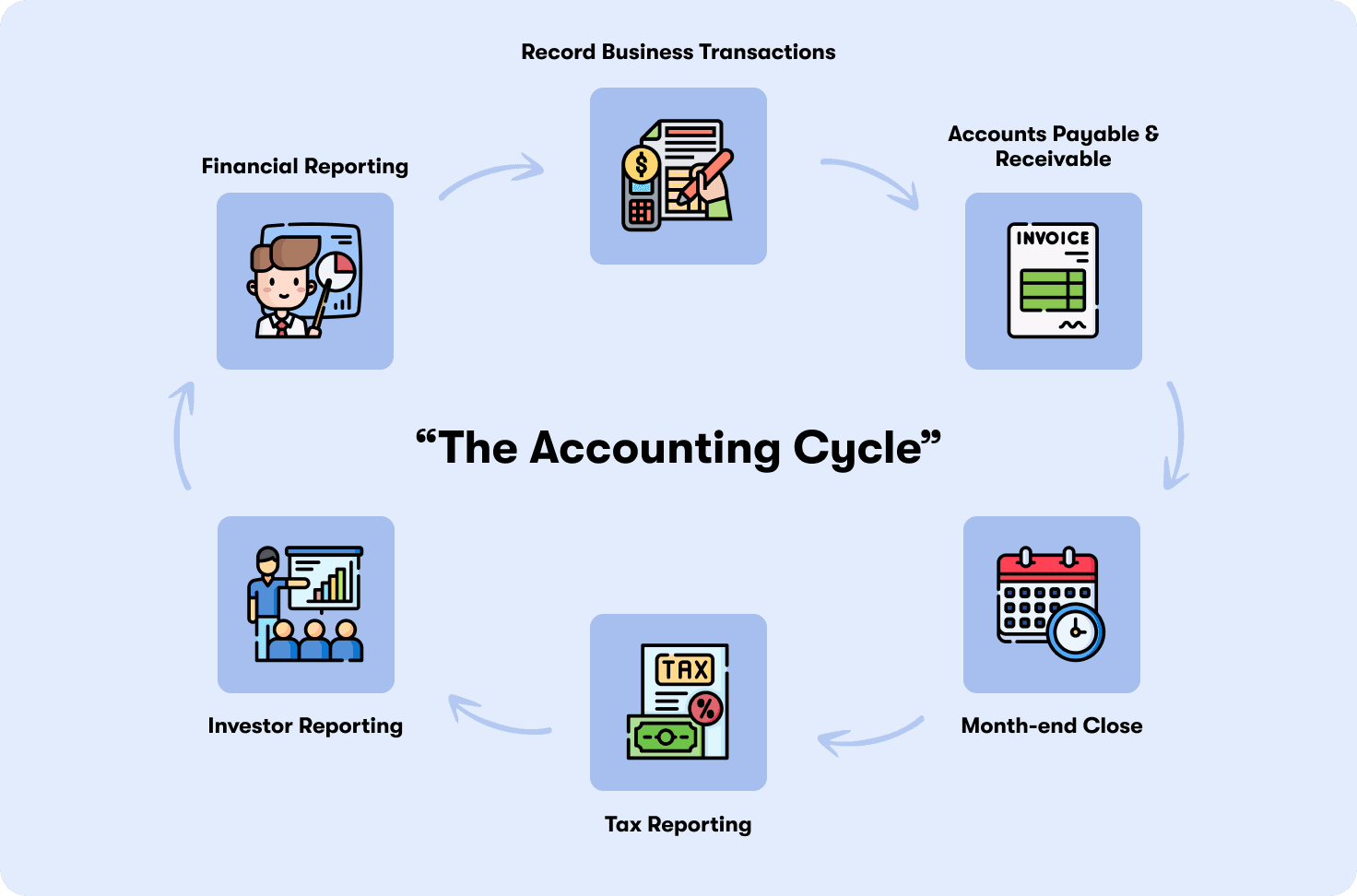

Over 8 hours of video lessons across 6 modules, you’ll learn how to apply the Accounting Equation to real-world transactions, record revenue and expenses using Accrual Accounting under US GAAP, and navigate the month-end close process with clarity—including key accruals and adjusting entries.

You’ll also dive into financial statement analysis—income statement, balance sheet, and cash flow—to assess business performance like a pro. The course breaks down the full Accounts Payable cycle, including three-way matching and vendor payments, and introduces you to tools like QuickBooks and FloQast to streamline your workflows through automation.

By the end, you’ll have the job-ready skills to support month-end close, perform meaningful analysis, and contribute to a high-functioning accounting team. Ideal for junior Accountants, finance grads, and career-minded Accountants looking to level up.

After completing this course, the learner should be able to:-

Define the Accounting Equation and apply it to the various types of business transactions

Apply US GAAP principles and use Accrual Accounting to record revenues and expenses

Distinguish between the various Month-End Close Procedures including revenue and expense accruals.

Apply Accounting principles to Financial Statements’ analysis including the income statement, balance sheet, and cash flow statement, to evaluate business performance.

Recognize the various tasks in Accounts Payable including three-way matching, vendor invoice approvals, and payment processes in an accounts payable system.

Identify the various aspects of Accounting Software & Automation – including (QuickBooks) and automation tools (FloQast) to streamline financial processes

Course Details

Duration: 8 hours

Access Duration: Lifetime on-demand access

Field of study: Accounting

CPE Credits - NASBA: 10

Knowledge Level: Basic

Delivery Method: QAS Self-Study (on-demand video lectures)

Prerequisites: College level Intermediate Accounting course

Advanced Prep: None

Controller Academy LLC is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its web site: www.nasbaregistry.org

Accounting

College Students

If you are in your final year of college and want to learn how Accounting works in a real company setting.

Staff & Senior Accountants

You’ve started to learn the ropes of Accounting, but want to push your career forward to a Manager/Controller role in the next 1-2 years!

Controllers & CFOs

You’ve worked as a Controller and CFO and you want to learn from my long experience in the Accounting profession.

Career Switchers!

You are planning a career switch into Accounting. You’ve either taken a couple of Accounting courses or worked in Accounting field in the past.

You own (or will own) an Accounting firm

You will learn the Accounting, analysis,reporting, and financial system skills to provide exceptional service to your clients.

*Refund Policy:

We encourage you to sample a course (watch a few lectures, browse the materials) within the 14 days. That’s what the guarantee is for. If you’re not feeling it, just let us know early — before you go through the entire course and grab the certificate.

You must consume less than 25% of the course videos, otherwise, we may issue a prorated refund. If the course is viewed 100%, no refunds are allowed.

STEP 1

STEP 2

STEP 3

STEP 4

ABOUT ME

I have had 18+ years of progressive roles in Accounting and Finance, both in Manufacturing and SAAS.

I summarize my experiences in my courses, so you don’t have to spend years learning them!!

Get Access to the Course

(4.9 out of 5)

This course covers all accounting aspects such as Debit and Credit rules, Billing, Payroll, AR, AP, Moth-end close and the most important Financial report analysis. “Highly recommended to those who really want to reach at the peak of your accounting profession”.

Munaf Patel

Staff Accountant

Bill does an excellent job explaining key concepts, supported by clear examples. As someone who speaks English as a second language, I found his explanations to be easy to comprehend

Carlos

Student

You make all finance related topics so easy to understand. It's help me a lot in my day to day work. And in my interview preparation as well. Thank you for making these videos.

Sourav Sahu

Manager

Bill's lecture does not take much of my time as it is very short and straightforward. The best part is that he includes a real-world application of the most important principles, which is indeed effective. The price is worth investing.

Gerald

Accountant

I think this course is very useful and helpful. Bill's teaching is concise and to the point of which I'm using right now to help self-learn the skills I need before I start my new role as a Junior Financial Controller!

Kevin

Junior Financial Controller

That is probably the best & most succinct explanation of these 3 ratios. Look forward to watching more of your videos.

Alex Davidson

Student

Read more reviews here.

No worries, we’ve got you covered :)

Got Questions?